By Marta Lillo

Before applying to this U.S. investor visa program, EB-5 investors must carefully consider all the standard and potential costs associated with an EB-5 application.

Besides the mandatory investment and filing fees required by the United States Citizenship and Immigration Services (USCIS) for the EB-5 program, there are also legal, administrative, and due diligence costs needed during the application process.

These extra expenses guarantee that the application is appropriately prepared and adheres to the legal requirements set out by the EB-5 Reform and Integrity Act of 2022 (RIA) and other regulations.

Legal services fees could include assistance with securing funding and legal documentation, while administrative services can involve document preparation, translation, and notarization, among others.

EB-5 project due diligence is also a necessary legal and administrative cost and should include background checks on the regional center or project developers and tax and financial analysis.

USCIS filing fees for the EB-5 immigrant investor program

Since RIA in 2022, the minimum required EB-5 investment is $800,000 for a project located in a Targeted Employment Area (TEA) and $1.05 million anywhere else (non-TEA) in the U.S.

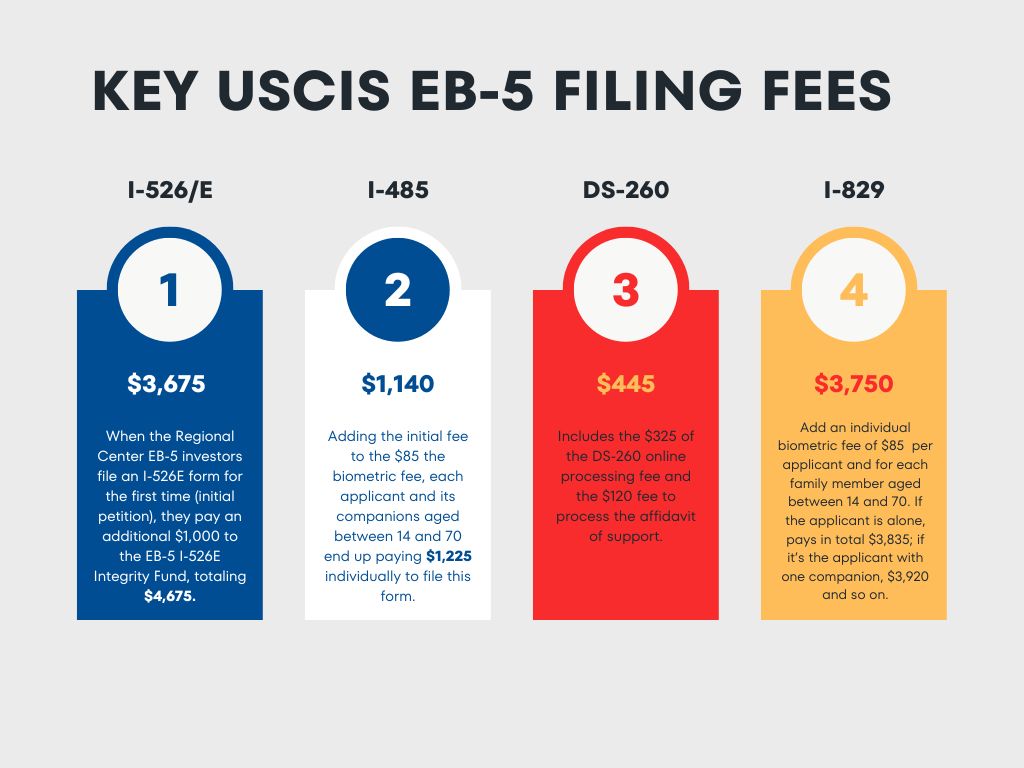

Besides the investment, applicants must also pay the filing fees for the three to four EB-5 forms they must complete as part of this investor visa process.

Filing fee for Form I-526

Filing this form is the first stage to obtain an EB-5 visa. Only an immigration attorney can file it. There are two kinds of I-526: the I-526 that a standalone investor files and the I-526E filed by a Regional Center investor.

The fee is $3,675 as of November 2023 for either form.

However, this fee increases when a Regional Center investor files an I-526E form for the first time (initial petition). According to the USCIS fee calculator, besides the $3,675, the investor pays an additional $1,000 to the EB-5 I-526E Integrity Fund, totaling $4,675 (this is separate from the annual payment the Region Center makes to the Integrity Fund between Oct. 1 and Oct. 31).

If the Regional Center investor amends a previously filed I-526 petition (post RIA 2022), the fee remains $3,675.

The fundamental purpose of the I-526 petition is for the EB-5 applicants to prove that their capital investment comes from a lawful source of funds. Therefore, the EB-5 applicant must provide traceable evidence proving the funds are of legal origin.

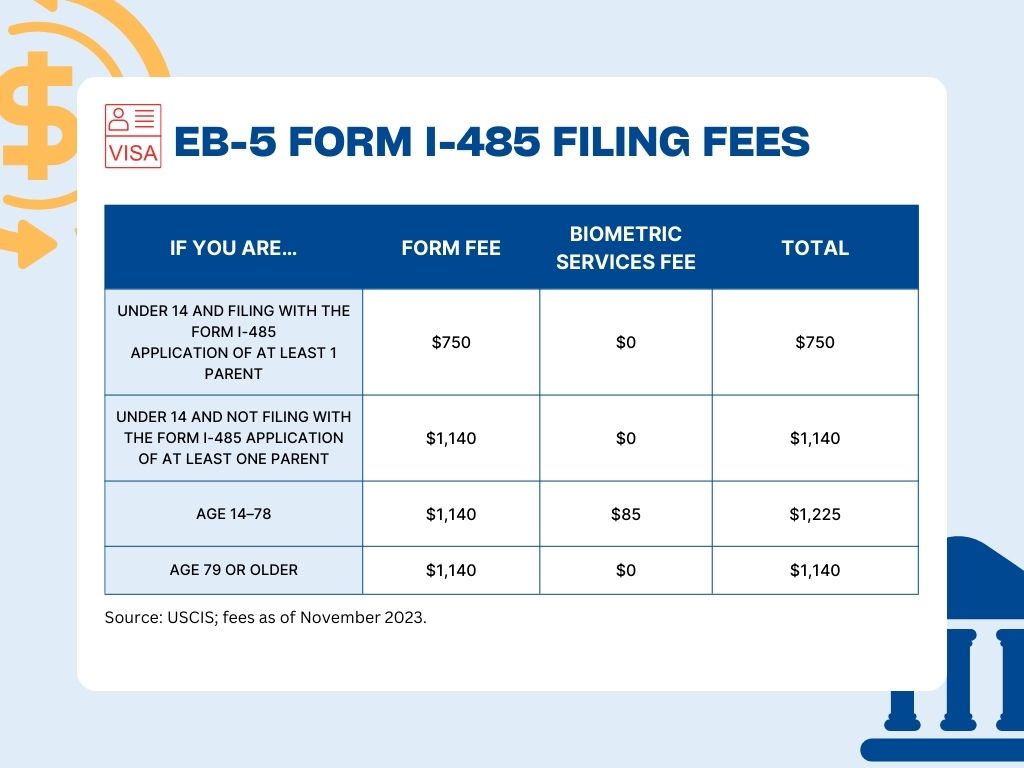

Filing fee for Form I-485

This form aims at adjusting status from nonimmigrant to conditional permanent resident but only applies to EB-5 investors already in the U.S.

The fee is $1,140.

Applicants filing an I-485 also pay a $85 biometrics fee individually; the investor, current spouse or a former conditional permanent resident spouse, or dependent permanent resident children between 14 and 79 years of age included on the petition must pay this fee.

Adding the initial fee and the biometric cost, each applicant and their dependents aged between 14 and 70 end up paying $1,225 to file this form.

Filing fee for Form DS-260

This form only applies to EB-5 visa applicants not in the U.S. upon approval of their I-526.

The fee for this form varies on the age of the EB-5 applicants and whether they are required to pay a biometric fee.

As of November 2023, the USCIS requires different amounts that total $445; including $325 of the DS-260 online processing fee and $120 to process the affidavit of support.

Applicants can file the DS-260 form online at the Consular Electronic Application Center or through an immigration attorney at a U.S. consulate or embassy abroad.

The relevance of this form is that it grants admission to the U.S. to continue the EB-5 process there.

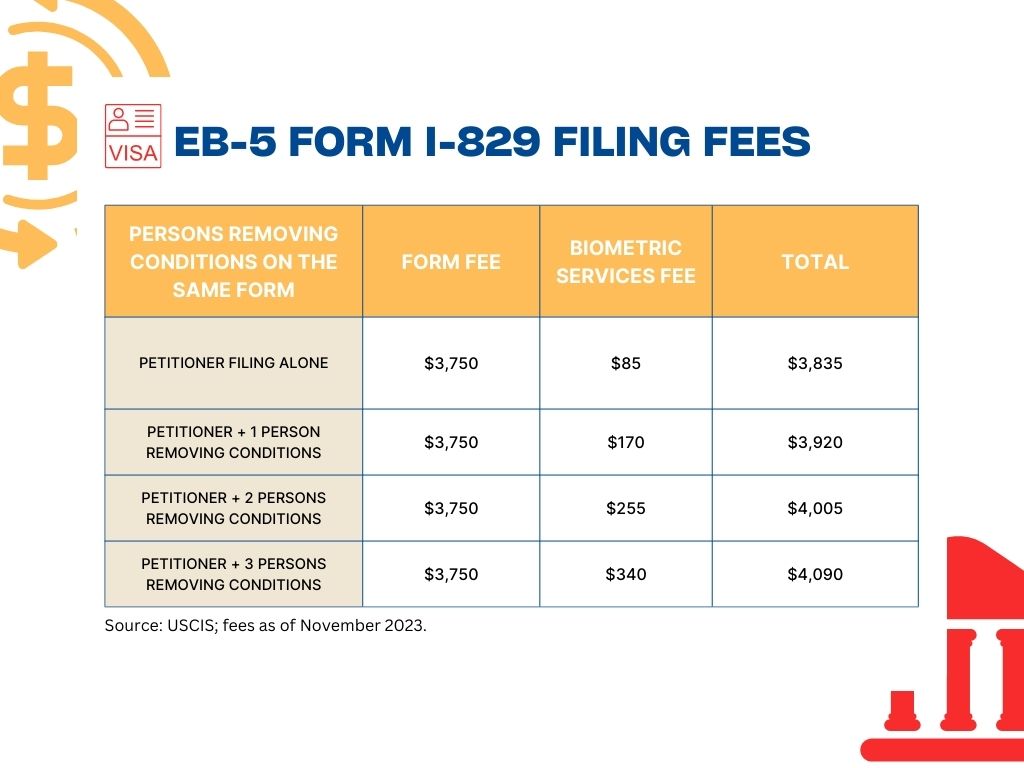

Filing fee for the I-829 Petition

Filing this form is the final stage of the EB-5 process.

The cost is $3,750 as of November 2023.

Form I-829 petitioners are also required to pay a biometric services fee. It is $85 per individual, so the total payment depends on the number of family members included in the petition; for example, if the investor only has one dependent, the biometric fee increases to $170, and so on.

The primary goal of this application is to enable the investor to obtain lawful permanent residency in the U.S. Once the I-829 form is approved, the conditional residency restriction on the investor, their spouse, and their unmarried children under 21 is lifted, making them eligible to reside permanently in the country.

Besides these mandatory fees, there’s the I-765 for Employment Authorization form (EAD), which costs $410 plus a $85 biometric fee individually, although some exemptions apply.

There’s also the application for Advance Parole (travel permit), which has different costs depending on the age of the applicants and their family members. The individual fee is $575 for applicants or family members aged between 14 and 79, plus an $85 biometric fee.

How are USCIS fees paid?

An EB-5 applicant can pay filing fees with a money order, personal check, or cashier’s check, or pay by credit card using Form G-1450, Authorization for Credit Card Transactions. Check payments must be made payable to the U.S. Department of Homeland Security.

The agency explains that “filing and biometric services fees are final and non-refundable, regardless of any action we take on your application, petition, or request, or if you withdraw your request.”

Legal fees required to file forms and other EB-5-related services

Many investors employ the services of an immigration attorney to help them handle the processing and filing of these applications and the due diligence required for the EB-5 projects they will invest in, which might incur extra costs.

Some investors might also hire tax experts for pre-immigration tax planning.

According to Edward Beshara, EB-5 immigration attorney and managing attorney at Beshara PA, the beginning of this relationship between the EB-5 applicant and its legal advisors begins with an initial legal consultation, for which fees can range between $200 and $350.

Once representation of the EB-5 investor formally begins, other fees apply. First, the immigration attorney must advise the client on the required legality of its source of funds (SOF) and, second, on the project documentation.

“First, advising and assisting the EB-5 investor to authenticate the lawful source of their investment funds to be committed and invested in the EB-5 project. The USCIS requires substantial proof and clarity for the source of funds based on the preponderance of evidence. Usually, several thousand pages to prove a lawful source of funds is the norm,” Beshara says.

Once the SOF is resolved, the EB-5 immigration lawyer advises the client on project documentation, including business plans, economic reports, securities offerings, etc.

The attorneys spend a considerable amount of time providing this type of advice, including web calls, phone calls, and email correspondence. The fees regarding this stage in legal representation, which includes preparing USCIS forms for filing, can range between $20,000 and $25,000 plus costs, Beshara adds. He says that in the case of preparing the I-829 petition in particular, the value can range between $10,000 to $15,000 plus costs.

Meanwhile, according to Beshara, the fees for preparing applications such as the I-756 and the I-131 can range from $2,500 to $3,500 per individual, excluding additional costs. The same fees may apply if the EB-5 investors or their family members choose to apply for conditional permanent residency through a U.S. Consulate, he adds.

Beshara concludes that other attorneys’ fees could be required if the USCIS requires a Response to a Request for Further Evidence (RFE) or Notice of Intent to Deny (NOID) during the EB-5 process, depending on the hours involved in preparing these replies.

Meanwhile, Rakesh Patel, managing partner of Patel Law Group, explains that the investor who files through consular process would need to consider the following fees: “NVC Immigrant Visa Application $345.00 for investor and qualifying derivatives; USCIS Visa Fee $220.00 (paid prior entering the U.S.) for investor and qualifying derivatives; cost for processing the investor and qualifying derivatives documents such as police clearance certificate, photographs, biometrics, medical exam and translations for any documents in a foreign language.”

As for EB-5 applicants investing in their own business, other costs associated with the process could be and vary depending on the immigration attorney: “Deal side attorney fees; Department of State fees for company formation (varies per state); Business Plan for the NCE entity; translation of documents for any documents in a foreign language; health insurance cost,” he says. Also, if it’s a Regional Center (RC) project, “there would be an administrative fee from RC.”

The EB-5 investor should also take into consideration “bank transfer wire fee, administrative fee related to the investment (if any). There could also be administrative fees from the developer or RC, travel costs, accountant fees, agent fees, etc.,” Rakesh adds.

Fees for EB-5 investors who file a legal claim against the USCIS

Another expense to consider besides the mandatory USCIS fees and legal and administrative costs is hiring legal representation for a Mandamus action against the USCIS in Federal Court.

This fee is voluntary and should be budgeted separately from other costs, Beshara says. “The average attorney’s fees for the repreparation, filing, and dialogue with the Federal Court Judge and U.S. Government attorney will be between $10,000 to $15,000 (these fees are based on the assumption that there may be no need for a Summary Judgement representation),” he explains.

USCIS fee hike planned for 2024

However, mandatory USCIS filing fees for EB-5 immigration applications and petitions are expected to increase in 2024, per the agency’s announcement, to cover expenses, speed up processing, and reduce reliance on federal funding.

The proposed fee hike would increase the rate for the I-526 application by 204% to $11,160 from the current $3,675. The hike would represent a 40% overall weighted average, compared with 21% in 2016, the last time the agency adjusted its costs.

It is also important to note that EB-5 investors may get the full or part of their invested money back when their immigration and investment cycles are completed.

DISCLAIMER: The views expressed in this article are solely the views of the author and do not necessarily represent the views of the publisher, its employees. or its affiliates. The information found on this website is intended to be general information; it is not legal or financial advice. Specific legal or financial advice can only be given by a licensed professional with full knowledge of all the facts and circumstances of your particular situation. You should seek consultation with legal, immigration, and financial experts prior to participating in the EB-5 program Posting a question on this website does not create an attorney-client relationship. All questions you post will be available to the public; do not include confidential information in your question.