by EB5 Investors Magazine Staff

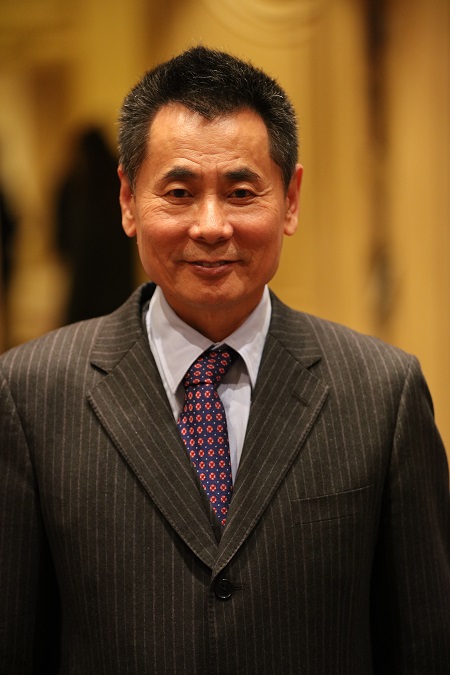

Dr. Winner Xing of Chinese immigration agency Worldway Group spoke with EB5 Investors Magazine about which concerns he’s heard from Chinese investors about the EB-5 program, what they look for in an investment opportunity, and how Worldway continues to support investors once they’ve moved to a new country.

EB5 Investors Magazine: What is the most popular immigrant destination for your clients?

Winner Xing: We have four (specialties): the United States, Canada, Europe, and the British Commonwealth. The United States and Canada have larger application amounts.

EB5 Investors Magazine: Since you’ve been in this industry for a long time, what are your clients’ biggest concerns about the EB-5 program? Just based on your daily connection and communication with clients.

Winner Xing: There are two. The first is the risk of their investment. Clients are worried about their investment money because the investment is by nature under risk. Sometimes EB-5 projects have some problems. The second is worry about its job creation risk, because at the beginning the clients only obtain a conditional green card. They can remove the condition only when the job creation fulfills the program’s requirement. So they know that whether they complete the job creation requirement decides whether they get the permanent green card. They know that the risk of job creation is the risk of their green card. Recently, we found that with the EB-5 program extension, there are more and more applicants. So more and more petitions accumulate in (USCIS), and the waiting time is extended. So (our) clients now have a third concern, which is the petition waiting time. If the EB-5 application waiting time is extended, it has impact on both their investment and their future immigration plan.

EB5 Investors Magazine: As you said before, the two consistent concerns are investment risk and job creation risk. As a migration agency, the solution is due diligence, right? What do you think are the three most important things in project underwriting?

Winner Xing: The most important thing is the selection of the project. Who is the investment subject? This is the key. No matter how well a due diligence is conducted, it is just a security lock. Any due diligence method has its limitations. The investors care about who is the investing party. We will evaluate the investment subject by checking their history, experience, capability, and reputation. The second thing investors care about is the investment structure. It includes both the project cover rate and EB-5 fund percentage. In general, if the EB-5 fund takes a smaller percentage and the cover rate is lower, the risk to the investors will be relatively lower. Some projects have high cover rate, consisting of more than 90 percent bank loans, fund loans, and EB-5 loans. These kinds of projects could bother the investors. This is the second problem investors are concerned about. Then the third issue investors (are concerned) about is job creation. The biggest concerns are the job calculation method, and the cushion job numbers. What the investors know is an estimated job creation number when they start the application. The number could be taken into consideration as long as its deemed to be reasonable. However, after two years a real job creation report needs to be submitted. There is always a difference between expectation and reality. If the cushion job number – the part of the expected job creation number that exceeds the required job creation number—is higher, the investor will feel safer. Of course this cushion can’t be endlessly high, after all there is total job creation volume. In most cases, if the cushion job creation number reaches 30 percent higher than the actual required number, investors will feel safer. The higher this percentage is, the better. In terms of the calculation method, it is riskier for operational jobs because there are more uncertain factors that influence the future operation. So depending too much on operational job numbers would make the investors worried.

EB5 Investors Magazine: What kind of project is Worldway seeking now?

Winner Xing: We do not have a preference. Among the projects we’ve been promoting are hotel, apartment and new energy projects. We did quite a few new energy projects already. Specifically, we did solar energy projects, and had success. So we don’t have preference for project type. However, we do consider the prosperity of an industry. For example, now the petroleum industry is not prosperous, and investors (are wary of those projects). So if there is a petroleum project, we don’t want to boldly step in. We think project selection is like stock selection, you need to look at the industry’s situation. If the industry is not prosperous, it is hard to count on someone to bring the project to success through management. It will also increase the difficulty of management, in general. For hotel projects, I also know that there are many hotel projects everywhere, so we usually conduct a specific analysis for hotel projects too. For example, we have a Four Seasons hotel project in Puerto Rico, a holiday resort type hotel. We think this is a very good project because Puerto Rico and the Caribbean Sea area are tourist attractions. This location is very suitable to build a resort type hotel. So we believe it is easier for the investors to accept this project. The real situation proves the acceptability of this project is very high. Yet it doesn’t mean we embrace all hotel projects at any location. Hotel project depends on operation (and) its future revenue counts on its operation, so we will scrutinize the hotel location and hotel type.

EB5 Investors Magazine: What do you think is the biggest obstacle for developing EB-5 in China? For example, competition and government control?

Winner Xing: We think the biggest obstacle is the waiting time. In the past, the U.S. program had the time advantage compared to Canadian program. The U.S. program was faster. As far as I recall, two or three months, one or two months for approval. Now the waiting time is longer and longer. EB-5 investment is an entity investment, and if the processing time extends, it conflicts with the nature of entity investment because the construction time of an entity has a limit and the fund injection is according to a plan. However, if your EB-5 time is uncertain and has an extension, it will increase the risk, even may drag down an originally good project. The investor’s immigration plan has a timeline too. If the whole immigration process takes a long time and is full of uncertainty, the investor’s immigration goal and motivation could have changed drastically. This is why we think it is a big problem. We hope that in the Congress’ future discussion, the (reduction) of waiting time could be considered, and solution and strategy could be applied. This is the problem we see, other than that there is no obvious obstacle. Since people already know EB-5 investment is risky, but the attraction of green cards exist, the investor would find a balance between risk evaluation and green card attraction. Of course if the investor has concerns about investing in the U.S., we will suggest they invest in Canada, Europe and other British Commonwealth countries.

EB5 Investors Magazine: Which one do you think is more important, the reputation of a project or the reputation of a regional center?

Winner Xing: Usually, a migration agency will take a look at the regional centers and select the familiar ones. This is because through long-term collaboration, there is a trust built. If the project belongs to an unfamiliar regional center, they will be concerned about any possible issues happening in the future. So migration agencies consider the collaboration history and experience as important things. However, we found that in real investment behavior, investors don’t really care about the regional center. The care more about the project. For example, if you’re promoting a project with a very good investment subject, investment structure, and job creation calculation method, even if it belongs to a not-very reputable regional center or an unfamiliar regional center, the investor will invest in the project. Maybe even after his petition is approved, he still doesn’t know the regional center’s name. So, investors focus more on the project itself. Because of this, migration agencies also focus more on the project. If have to pick up one from the two, I believe migration agencies will put the project first, because investors put this first.

EB5 Investors Magazine: Does Worldway work with time-tested regional centers only, or do you work with some new centers as well?

Winner Xing: We have both. We take the regional centers that we’ve collaborated with before more seriously, because we have worked on projects together. Both sides want a long-term collaboration, and the two sides are more responsible to the investors during our collaboration. Usually, an unfamiliar regional center may have difficulty getting connected with us because they don’t know us. But as long as we get connected, if they have projects that we’ve approved, we would like (to work with them too). So in recent years, we have promoted projects from both our old partners and newly connected regional centers.

EB5 Investors Magazine: How does your company deal with relocation services? Do you have a third party involved or do you have your own company branch? Do you offer those services?

Winner Xing: The after service is a must. The one thing that distinguishes Chinese investors and European investors is the language barrier. For European investors, they have fewer language problems while Chinese investors have a large problem. This is why we care about relocation in a foreign county a lot. So far Worldway has three service centers outside of China. We are in Los Angeles, in Lisbon, Portugal and Cyprus. We are working on setting up the fourth service center in Canada. Our customer service center is responsible for client’s relocation services. However, more specific services are all transferred to local third parties. The responsibility of our service center is to build connection between our clients and those professional service providers, to make sure those companies provides high quality services to our clients. So we’ve been building a positive relationship with local service providers. In our long-term collaboration, we select companies with very good reputations, very considerate services, and reasonable prices to provide services to Chinese investors. So far we are very content with their work.

EB5 Investors Magazine: So this solution, for Worldway, is more efficient. But do you have any future plans for expanding relocation services?

Winner Xing: Yes. The next step we will take is to set up a New York office. Though our customer service center is located in Los Angeles, our service covers the entire U.S. We have our network reaching out to New York, Seattle, Huston, Dallas and Chicago, all cities with a condensed Chinese population. Our Los Angeles service center is only responsible for communication. We have customer service in China, as well as Europe and the United States. Our customer service end in China also communicates with the U.S. office. The U.S. office is then responsible for carrying out the requirements to guarantee our clients get the best service in time.

EB5 Investors Magazine: As long as it is an immigrant population-concentrated area, all services are in general guaranteed.

Winner Xing: Yes. It is impossible for a migration agency to handle everything by itself. You need to set up a real estate agency; you need to set up an insurance agency. Every place has its local system for all these services. We connect with them, and ask the professional institution to provide services. We think this serves our clients better.

EB5 Investors Magazine: What is the company’s development plan in the future?

Winner Xing: We have two visions now. One is that Chinese immigration (industry) moves from vicious competition to association. We have a new competition relationship pattern called “collampete”—collaborate and compete. In the new year, we will collaborate more with other agency in this industry, we will share sources of good projects. There is no need to open new offices everywhere. Of course we could do that, based on our capability, we could cover the whole county in two months. But that is not too meaningful. We want to collaborate with people within the industry, sharing high quality projects. The other thing is our collaboration with overseas projects. We will build a platform, and hopefully post high quality projects on the platform so that everyone could share this resource. I think this will help to push transparency on project promotion. Migration agencies, no matter small or big in size, could benefit from it. Meanwhile, investors could compare the projects, and select the best project based on their investment preference and risk factors. It creates a better selection space for investors. This is the direction for our future development.

EB5 Investors Magazine: How many EB-5 events do you attend each year?

Winner Xing: I started to attend conferences in 2009, but there was less choice at that time. Now there are more and more conferences. Some of those conferences are in the U.S.; some are China. At the beginning I didn’t really want to attend this kind of event, because the impact of investment immigration in China is relatively weak. I didn’t think talking a lot could have a good effect. But now, especially in the United States, the investment immigration program has been developing for 10 years. Investment immigration becomes a common individual overseas investment solution. It is necessary for us to convey the best idea of investment immigration to our Chinese investors. In the past two years, I’ve participated in more conferences, maybe two or three or four each year. In fact, when I present at a conference, I mostly talking about an idea rather than introducing Worldway or our projects. I almost never introduce our projects, and rarely mention Worldway. Most of the time, I promote the idea. We deliver the ideas of Worldway by attending those conferences, as well as sharing our experience and thoughts with other agencies.

Translated from the original Chinese article.

DISCLAIMER: The views expressed in this article are solely the views of the author and do not necessarily represent the views of the publisher, its employees. or its affiliates. The information found on this website is intended to be general information; it is not legal or financial advice. Specific legal or financial advice can only be given by a licensed professional with full knowledge of all the facts and circumstances of your particular situation. You should seek consultation with legal, immigration, and financial experts prior to participating in the EB-5 program Posting a question on this website does not create an attorney-client relationship. All questions you post will be available to the public; do not include confidential information in your question.