By John Roth

In 2014, Indian nationals accounted for less than 100 of I-526 filings. Last year, Indian nationals accounted for an estimated 500 or more I-526 petitions. What is driving demand?

H-1B VISA INSECURITY

Between 2007 and 2017, 64 percent of H-1B beneficiaries were citizens of India. The next closest country of origin, China, accounted for only 9 percent of the total. Estimates put the number of Indian nationals working in the U.S. on an H-1B visa, plus their dependents, at between 500,000 and 750,000 individuals.[1]

The Trump administration’s “Buy American, Hire American” agenda has put pressure on H-1B holders from several directions. The rate of RFEs for January to August 2017 for H-1B applications increased 45 percent compared to the same period a year earlier. Last October, USCIS advised its officers to “apply the same level of scrutiny” to extension requests for the H-1B visa (among other visas), rescinding the previous guidance that gave deference in most cases to previously approved visas. In addition, USCIS called for increased scrutiny on H-1B cases involving third-party consulting assignments in its Feb. 22, 2018, policy memo, PM-602-0157.

Most ominously, the U.S. Department of Homeland Security is considering new regulations that would eliminate the AC21 benefit by which H-1B holders have been able to remain in the U.S. while waiting for their EB-2 or EB-3 green card. Although USCIS has recently reassured H-1B holders that they will not likely be deported based on the proposed regulations, USCIS’ Chief of Media Relations noted in a statement that extensions could be requested under the new regulations, but only in one-year increments under section 106(a)-(b) of AC21.

EB-2 AND EB-3 BACKLOG

Indian nationals have long relied on the EB-2 (Advanced Degree / Exceptional Ability) or the EB-3 (Skilled worker / Professional) visa as their primary means for obtaining U.S. permanent residency.

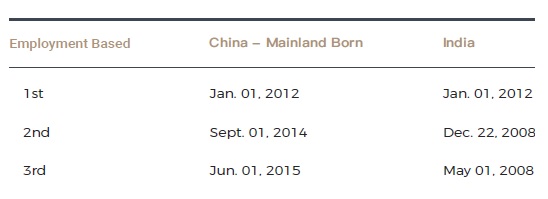

The per-country limits of the EB-2 or EB-3 visas have resulted in wait times of nine to ten years for Indian nationals to be eligible to file for LPR status, according to the U.S. Department of State’s Visa Bulletin. As discouraging as the DOS priority dates are to Indian EB-2 and EB-3 applicants, the situation, in fact, is considerably worse.

PRIORITY DATES

Priority dates for Indian EB-2 and EB-3 move slowly, and in some months, not at all, retrogressing several times. In fact, the July 2016 Visa Bulletin featured a massive four-year retrogression in EB-2 for India. What’s more, one analyst who took a close look at the likely inventory of EB-2-based I-485 applications calculated wait times in the neighborhood of 100 years.[2] As stated on GCReforms.org, “There is [currently] little hope for a skilled employment based worker from India to get a Green Card in their lifetimes due to their per-country limits.”

SCHOOL-AGE CHILDREN

Between 2007 and 2017, 69 percent of H-1B filings were for workers ages 25 to 34. An additional 22 percent were ages 35 to 44. Inasmuch as these age groups encompass the prime childbearing years (the vast majority of Indian H-1B holders are married), a high percentage of Indian H-1B holders are residing in the U.S. with young children. Many of these children were born in the U.S. and are already U.S. citizens. Most are in schools and have been deeply acculturated to the American Way of Life. India is a foreign country to most of them. One can easily imagine how keenly all members of these families wish to remain in the U.S.

INDIAN REAL ESTATE MARKET

Indian workers in the U.S. typically don’t have $500,000 in liquid funds to invest in an EB-5 visa, not to mention the $1-million net worth or salary levels required to be qualified as an accredited investor under U.S. securities law. Government data indicates that 84 percent of H-1B applicants will earn less than $125,000 per year in their first year of work in the U.S. Some growth in annual salary is likely, of course, but even for two-earner families, the relatively short amount of time that the families have spent in the U.S. means that few families have sufficient savings to fund an EB-5 investment by themselves. Most of the balance comes from a gift financed by the sale or mortgaging of property owned by parents or other relatives of the U.S. resident worker or spouse.

Fortunately for these investors, real estate values in India have increased greatly in recent years. A combination of new residential and commercial uses for properties that had once been agricultural, improvements in infrastructure, increases in population growth, the current enthusiasm for real estate as an investment, plus the sheer length of time the properties have been held by older Indians, have all combined to raise property values 40- to 50-fold in the last 50 years.[3]

INCREASED EB-5 MARKETING IN INDIA

With the dramatic decrease in EB-5 investors from China due to visa retrogression, regional centers have in recent years been increasing their marketing efforts in India. But the Indian market is not likely to be as productive as the China market.

The China market was in many ways an ideal marketplace for regional centers seeking investors. Due to social conventions and language challenges, Chinese investors sought advice principally, if not solely, from the local emigration agent, whom they could see and understand (and yell at if things went wrong). They rarely conducted their own independent research of an EB-5 project or engaged the services of a financial advisor when making investment decisions. This allowed the Chinese agents to commoditize and aggregate investors for sale to regional centers in blocks of 10, 20, 30 and more investors.

The Indian agent market is much different. It is far less extensive than the Chinese network of agents. The Indian agents have a significantly lower level of market penetration of the potential investor population when compared to the China or Vietnam models. In addition, potential investors have the advantages of English fluency and unrestricted internet access, giving them far better ability to conduct independent research and to communicate directly with regional centers. This independence in the target class of potential investors makes it all but impossible for even the largest Indian emigration agency to deliver investors in bulk, making investor acquisition more time-consuming and more expensive for the regional centers.

Still, marketing by EB-5 promoters in India has already increased the awareness of the benefits of the EB-5 visa, and the resulting rise of primary demand is leading to ever increasing numbers of EB-5 investors in India from which all in the EB-5 industry may profit.

IMPLICATIONS FOR EB-5 INDUSTRY

Some 59 percent of Indian EB-2 and EB-3 applicants are working in a computer-related field. Most of the rest are from other learned and skilled professions: doctors, nurses and skilled technicians. These skilled workers tend to be very analytical, are used to working in teams and rely on specialists to complete their work. Whether working with a financial advisor or conducting his own due diligence on EB-5 projects, the Indian investor is often a tough sell.

This rising tide of investors can be expected to contribute to a more meritocratic EB-5 marketplace of projects, with weaker projects falling by the wayside. It also makes fraud less likely in the EB-5 arena. Can anyone imagine 292 Indians signing up for a project run by a 29-year-old sponsor peddling fabricated documents, as we saw in the infamous project for a hotel and convention center development near Chicago’s airport? It won’t happen.

Sources:

[1] “Trump may deport thousands of Indian H-1B visa holders as they wait for green cards”, Quartz India, Ananya Bhattacharya | January 3, 2018

[2] See, e.g., Green Card Wait Time is 108.6 years for EB-2 Indians

By Rahul Reddy Attorney at Law 2/8/18 (http://www.rnlawgroup.com/immigration-news/584-green-card-wait-time-is-108-6-years-for-eb-2-indians), and, generally, https://www.gcreforms.org/key-issues/

[3] “The myth of real estate profits”, The Times of India: Business, Dhirendra Kumar| May 8, 2017

DISCLAIMER: The views expressed in this article are solely the views of the author and do not necessarily represent the views of the publisher, its employees. or its affiliates. The information found on this website is intended to be general information; it is not legal or financial advice. Specific legal or financial advice can only be given by a licensed professional with full knowledge of all the facts and circumstances of your particular situation. You should seek consultation with legal, immigration, and financial experts prior to participating in the EB-5 program Posting a question on this website does not create an attorney-client relationship. All questions you post will be available to the public; do not include confidential information in your question.