By Ronald Fieldstone

It is more than likely that there will be financial changes to EB-5 projects over time. Budgets and the financial capital stack is always a moving target. Other changes also include a change in the property manager, the contractor, the architect or other parties that were previously disclosed in the offering circular. The most common substantive change tends to be a change in the scope of the project and the capital stack where the project usually expands or encounters significant cost increases that needs to be funded with additional financing.

IMMIGRATION AND SECURITIES/CORPORATE ISSUES OF MATERIAL CHANGES

From an immigration issue, if a material change takes place in the EB-5 project prior to an investor receiving conditional residency status, then based upon the June 14, 2017 Policy Memorandum, this could result in a denial of the I-526 petition. The Policy Memorandum clarifies that once conditional residency status is obtained, then materiality is no longer an issue and only the creation of jobs and the maintenance of the “at-risk” requirements is required.

From a securities standpoint, there may be significant changes that could be deemed material from a securities standpoint. Generally, the concept of materiality under securities laws would include new information that would reasonably affect the investment decision of an investor if known in advance.

The issue here is the different perspective of “materiality” from each a securities and immigration point of view. If there is an acknowledgement of material changes to a project, this could otherwise impact the immigration risk as to an I-526 petition denial. Practitioners need to tread carefully with respect to how changes to a project are addressed.

From a corporate standpoint, there are provisions contained in the applicable partnership/operating agreement that may address changes to the transaction, and in particular, the loan transaction and/or the equity contribution provisions. Usually there is a provision for either the manager/general partner to have authority to make certain decisions on behalf of the EB-5 company or, the changes otherwise need the consent of the applicable members or limited partners.

HOW TO EVALUATE THESE FACTORS

Change in location: Is there a change in the location of the project? If so, is the change significant? For example, let’s say there is an eminent domain proceeding of a project and the development of the project is moved a few blocks away. Or, there is a termination of a lease and the project is relocated with a new lease within blocks of the original location under similar terms and conditions. These changes could reasonably be supported as non-material.

Debt vs. equity: Is there a change in the model from debt to equity? From an immigration point of view, this may not be deemed material since it does not affect the job creation or the at-risk issues, but clearly from a corporate point of view, there is a significant difference between a debt instrument and an equity investment given the priority of repayment. The modification could include a change in the priority of the EB-5 Loan compared to other debt on the project.

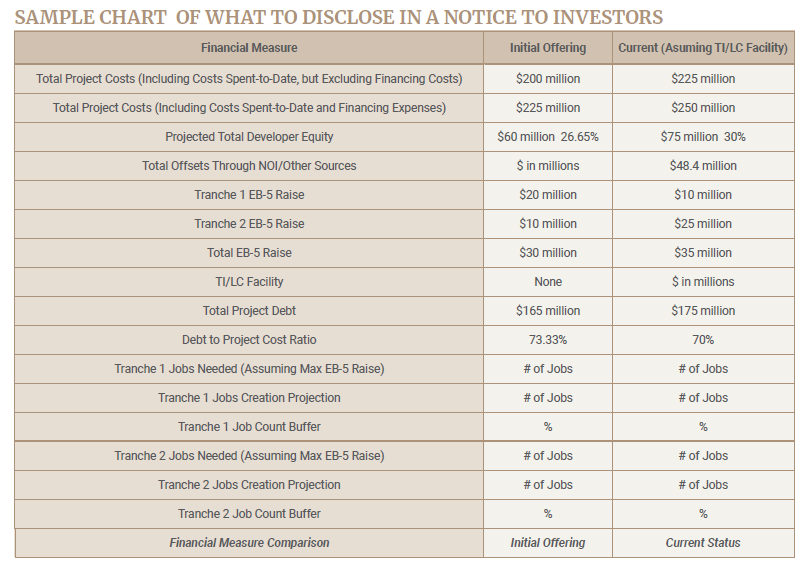

Change in Capital Stack: A change in the capital stack is the most significant factor in analyzing the significance of the change. Applicants should do an evaluation of the capital stack comparing the existing offering documents to the new capital stack, together with an indication as to whether the percentage ratios have been maintained. In other words, has the debt to cost increased? Has the overall value increase based upon an increase in cost taking into account the additional capital funding? Does the project substantially have the same percentage of equity coverage compared to the original offering and if there is a cost increase, does same otherwise entail an increase in value that would justify the cost increase? These are very important factors to take into account. Below is a sample chart indicating the type of analysis that would be appropriate to disclose in a notice to investors:

Substitution of Assets: In some cases not only are locations changed, but assets are substituted. For instance, a developer of a mixed-use phased project may elect to change the order of phasing due to economic circumstances. The key factor here is whether the original offering documents provide for the flexibility of the developer to modify the order of development or substitute locations or the real estate mix of the project, whereby the economic report and business plan take into account the applicable components and the potential substitution thereof in complying with immigration rules and regulations.

In connection with all of the above factors, it is always necessary to determine whether investor consent is required. This may not be clear cut if the applicable documents provide authority to the manager/general partner, since it could be argued that no consent is required. However, to the extent we are dealing with the securities issue involving a significant change to the original transaction, then obtaining investor consent could be appropriate.

THE PROCEDURE THAT COULD BE USED IF THERE IS A SIGNIFICANT CHANGE

1. Notice to investors of the proposed changes with a specific request for consent.

2. A similar notice seeking a confirmation instead of a consent. In connection with certain modifications, there may be a genuine issue whether consent is actually required, so that obtaining a majority in interest confirmation may provide some degree of protection to the manager/general partner. If the confirmation is not obtained, the general partner/manager would still need to evaluate whether it may proceed without the confirmation.

3. Similar notice as above except that no consent or confirmation is requested, but investors who have questions or concerns are invited to ask further questions. If an investor vehemently objects to what is being proposed, then that specific investor could be provided the right to withdraw from the investment.

4. In connection with any substantial change that would directly affect the initial offering documents, there is always an issue whether rescission right is required as opposed to merely obtaining the majority consent for the transactions to be undertaken. That may not be a clear cut issue.

5. Notice of meeting and related implications.

Clearly, the whole issue of substantial change, investor consent, and the potential for rescission has also become a key component in potential litigation proceedings being commenced by investors who may desire to obtain a refund of their investment for any reason whatsoever and are looking for any grounds to accomplish same. Therefore, it is even more important that the notification and approval process be undertaken very carefully in order to mitigate against claims that could be made. The above referenced analysis as to significant changes could likewise apply to the redeployment event and the need to provide notice to investors and obtain investor consent.

DISCLAIMER: The views expressed in this article are solely the views of the author and do not necessarily represent the views of the publisher, its employees. or its affiliates. The information found on this website is intended to be general information; it is not legal or financial advice. Specific legal or financial advice can only be given by a licensed professional with full knowledge of all the facts and circumstances of your particular situation. You should seek consultation with legal, immigration, and financial experts prior to participating in the EB-5 program Posting a question on this website does not create an attorney-client relationship. All questions you post will be available to the public; do not include confidential information in your question.