By Jennifer Mercier Moseley and Ashmin Chowdhury

As recently as 10 to 15 years ago, investors and others in the industry saw an EB-5 investment solely as an immigration transaction rather than a transaction that involves the intersection of many complex laws and regulations, such as U.S. securities laws.

Now, EB-5 investors are generally aware that regional centers are required to make certain disclosures to the potential investors, including risk factors related to the project and the job-creating entity (JCE), but to the extent due diligence is done on a specific investment opportunity, the main focus is on evaluating whether the project is a “safe” investment. That is, investors focus their diligence on whether the JCE will create the required ten jobs and stay in business so that there is a likelihood (or even near certainty) that the investor will obtain his or her permanent green card.

To a non-U.S. citizen seeking an EB-5 visa through an investment in a regional center, the actual process of making an investment may appear merely mechanical. However, determining whether to make an investment is not merely a determination of whether the investment allows investors to qualify for immigration benefits and maintains compliance with the Immigration and Nationality Act, U.S. securities laws, or any other applicable laws. While obtaining permanent residency may remain the most important goal to investors, they should also review whether the investment opportunity provides a likelihood of repayment of their capital investment. In addition, investors should review the opportunities to profit from their investments.

GETTING THE EB-5 INVESTMENT REPAID AND MAKING A PROFIT

Investors need to first decide their ultimate goal – once they obtain approval of their I-829, is their goal satisfied, or do they want to receive their capital back? Does the investor want to make a profit on his or her investment in addition to receiving back the capital investment? If investors are concerned about more than obtaining their permanent residency in evaluating potential investment opportunities, they will first need to understand the different forms of investment an EB-5 investor may be offered by a JCE. Ideally, investors should hire a financial or investment advisor who can help evaluate the investment opportunity based on the individual investor’s needs and goals because not all investments are the same just because the required ten jobs will be created.

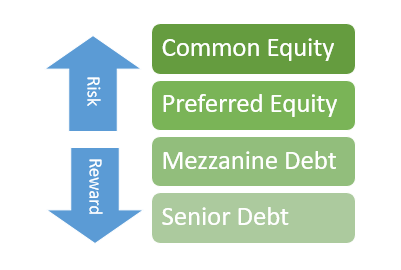

The different forms of investment can be broken up into four general categories: senior debt, mezzanine debt, preferred equity and common equity. An EB-5 investment through a regional center is typically made to the JCE as a loan, whether senior or mezzanine. A senior loan would be secured by the underlying property and/or other assets of the JCE, while a mezzanine loan is a lower priority loan and secured by a pledge by the owner of the JCE of the ownership interests in the JCE, rather than secured by the assets of the JCE. An EB-5 investment is sometimes, though not as often, made as an equity investment, which is an ownership interest in the JCE, and can be a preferred equity interest or a common equity interest. A JCE could have different investors with all four types of investments at the same time. Together, these forms of investment layer together to make up the “capital stack” for a transaction. Each EB-5 investor needs to determine where in the capital stack their risk tolerance and desire align.

HOW EACH TYPE OF CAPITAL RELATES TO EACH OTHER IN THE CAPITAL STACK

The illustration is a simple view of how each type of capital relates to the others in the capital stack. Senior debt has the lowest reward, meaning a senior lender will not receive any profits or gains if the JCE’s value increases, but it is the capital type with the lowest risk – that is, senior debt has the highest chance of being repaid.

At the top of the illustration is common equity, which has the highest potential for gains on investment but the highest risk that the investment would never be repaid because all other levels in the capital stack would have to get repaid before common equity holders receive any money.

Senior debt

For an EB-5 investor looking to minimize risk of nonpayment, senior debt would provide the best opportunity to get his or her capital investment back. Holders of senior debt receive first priority within the capital stack. An EB-5 investor who made an investment at the senior debt level would be paid first as principal and interest payments are made on the loan by the JCE. However, the return on investment for senior debt would be limited to the agreed-upon interest rate, and no additional profit would be made. An EB-5 investor would also need to consider whether a fixed or floating interest rate would be suitable given the market conditions at the time of the loan. These could impact the profitability of the loan. In a real estate transaction, the senior debt would also be secured by a first-priority mortgage on the real property, further minimizing the risk. If the JCE defaults on the loan, the investor can foreclose on the property. If the value of the foreclosed property is not enough to pay off the principal and interest due on the senior loan, the senior lender still has the right to be paid first out of any other assets of the JCE, before any other lender or equity owner gets paid.

Mezzanine debt

Further up the capital stack is mezzanine debt. Mezzanine debt is subordinate to (meaning, lower in priority than) senior debt and typically makes up a smaller percentage of the debt portion of the capital stack. Mezzanine debt holders still have a higher priority than the equity investors in the capital stack, making mezzanine debt less risky than preferred or common equity investments. Similar to senior debt, profits would be limited to the agreed upon interest rate. However, mezzanine debt is paid after the senior debt, which increases the risk of an EB-5 investor not getting his or her capital investment back. Additionally, mezzanine debt is not secured by real property in a real estate transaction. Mezzanine debt is secured by a pledge of the ownership interests in the JCE, meaning that if the mezzanine lender has to foreclose on the loan and take ownership interest in the JCE, the mezzanine lender is still subject to the full senior debt and any loan payments still due under the senior debt.

In other words, the security provided to EB-5 investors for a mezzanine loan simply means that the EB-5 investors become common equity owners, which is the bottom of the capital stack in getting any payments. The mezzanine lender would need to operate the business and any property upon foreclosure of the loan, which would require spending money to hire professionals since it is unlikely that the EB-5 investors have the ability to run the JCE’s former business. Many EB-5 investors target mezzanine debt investment opportunities because they view the existence of a senior lender, who has done its own diligence, as a sign that the JCE is a safe investment opportunity. However, a senior lender needs only to ensure it ultimately has adequate collateral for its security and that it has first priority in that collateral. If the project were to fail and the JCE becomes insolvent, the senior lender will foreclose on any real property and all other assets – and the mezzanine lender is left with a pledge of ownership in an insolvent entity.

Preferred equity

An EB-5 investor looking to maximize profit and who is less concerned about getting their capital investment back might be interested in making an equity investment. Preferred equity investments allow someone to make an investment in the indirect (through the JCE) ownership of the real property or other asset that is the target of the investment transaction. Preferred equity holders have priority when getting paid cash flow distributions over common equity holders, but there may be limitations on how much income the preferred equity investor is able to receive if the project does better than expected. Unlike the senior debt holder, the preferred equity holder has no collateral to fall back on but may have the opportunity to take control of the ownership entity if things take a turn for the worse, similar to the rights of the mezzanine debt holders.

Common equity

At the very top of the capital stack is the common equity. Common equity has the best potential return on investment if all goes well, but has the highest risk of receiving nothing if it does not. Common equity distributions are paid out last after all debt and preferred equity is paid out. In most cases, there is not enough income to go around and the common equity holders receive nothing. On the other hand, if the asset or real property outperforms expectations, common equity holders stand to receive the highest return on investment. In the case of a real estate investment, if the real property appreciates significantly and is sold, common equity holders have no limitations on how much they receive back and receive the greatest benefit relative to their capital investment.

Ultimately, EB-5 investors should take into account whether their investment will be repaid when reviewing whether a particular investment is a safe or good investment. As described above, not all types of investments create the same outcome for an investor. In addition to hiring immigration advisors who can help determine whether an investment will meet the conditions to enable the EB-5 investor to obtain permanent residency, EB-5 investors should consider hiring financial or investment advisors who can review an investment opportunity with a view towards repayment of capital and, if a priority for the investor, potential profits.

—

Ashmin Chowdhury

Ashmin Chowdhury is an associate in the Atlanta office of Burr & Forman, LLP. She represents financial institutions, as well as borrowers, in connection with both corporate and real estate loan transactions.

DISCLAIMER: The views expressed in this article are solely the views of the author and do not necessarily represent the views of the publisher, its employees. or its affiliates. The information found on this website is intended to be general information; it is not legal or financial advice. Specific legal or financial advice can only be given by a licensed professional with full knowledge of all the facts and circumstances of your particular situation. You should seek consultation with legal, immigration, and financial experts prior to participating in the EB-5 program Posting a question on this website does not create an attorney-client relationship. All questions you post will be available to the public; do not include confidential information in your question.