by Michael Streit

Immigrant investors, EB-5 professionals, regional centers and EB-5 project developers should have an in-depth understanding of how economists and the USCIS analyze the job-creation aspects of any EB-5 investment. Job creation, after all, is the foundation on which the EB-5 industry is based. This article will help potential investors and EB-5 professionals critically evaluate EB-5 real estate development projects from a job-creation standpoint.

Total Jobs Created vs. Total EB-5 Investors

The EB-5 program requires each investor to create at least 10 full-time jobs through the required investment. Professionals helping EB-5 investors should evaluate a project’s job creation report and determine whether it will create 10 jobs for every EB-5 investor. The real world is unpredictable, and it is possible that the project might not create all the jobs estimated in the job creation report. USCIS could disagree with the job creation estimates and reduce the projection or the project may not create all jobs calculated if certain assumptions in the report are not satisfied. Due to this uncertainty, projects should never seek a number of investors that would require 100 percent of the jobs estimated be created to satisfy the requirement that each investment create 10 jobs. In other words, projects should always build a jobs cushion into its offering and seek investors to account for only 80 – 85 percent of the jobs calculated in the job creation report. The purpose of this cushion is to ensure that every investor is credited with at least 10 jobs even if USCIS reduces the jobs credited to investors or fewer jobs are actually created by the project. For example, if a project is projected to create 1,000 jobs, the maximum number of EB-5 investors that should be supported would be approximately 80 to 85 (accounting for 800 – 850 of the jobs), because of the possibility that USCIS might reduce the number of jobs credited to investors or that the project may not create all estimated jobs. Due diligence requires one to verify that there is a sufficient jobs cushion to ensure each investor will be credited with 10 jobs in the event the project creates fewer jobs than anticipated.

Typical Job Creation Categories

In real estate development projects, economists typically break job-creation into construction and operational jobs.

Construction Jobs

Construction jobs are those created by building the project itself. These jobs are typically categorized as direct or indirect/induced. The job creation report should clearly state whether the construction jobs calculation includes both direct and indirect/induced jobs, because USCIS will only allow a project to include direct construction jobs if construction lasts more than two years. The two-year construction period must be reasonable and verifiable. The reasonableness of the construction period is determined by how long it typically takes to build a project of similar scale and quality in the project’s region. The job creation report and business plan should include a timeline showing what constructions tasks will be performed each month. This timeline should show exactly how much money will be spent each month during construction. All statements and assumptions regarding the construction period must be verified by a third-party that clearly states the basis for the opinion that construction will take more than two-years. If the timeline and two-year construction period are not reasonable and verified by a third-party there is significant risk that USCIS will reduce the number of jobs credited to investors. If the number of construction jobs credited to investors is reduced, an investor’s green card will be put at risk, because they could fail to satisfy the basic job creation requirement. Due diligence requires the verification that inclusion of direct construction jobs in the job creation report is supported by a two-year construction period confirmed by an independent third-party.

Operations Jobs

In the real estate development context, operations jobs can be created by businesses owned by the developer or by businesses owned by tenants leasing space within the development. USCIS allows operations jobs from businesses owned by the developer to be credited to EB-5 investors. However, if the operations jobs are created by tenants within in the development, USCIS has significant restrictions on when those jobs may be included in job creation calculations.

Economists typically use revenue to calculate the operations jobs created by a developer-owned business. Due diligence should focus on whether the revenue projections used for the job creation calculation are reasonable or attainable. Unattainable revenue estimates will result in a reduced number of operations jobs created by the project. If the job creation study includes operational jobs created by tenants of the development, USCIS will require proof that the tenant’s jobs are new and not merely relocated jobs.

This is an extremely difficult burden to satisfy and most EB-5 projects choose not to include tenant jobs in their calculations.

However, if a project tries to include such jobs, the project package must include an independent analysis showing that the area in which the project is located has an unmet demand for the tenant’s product/services. This independent report should also demonstrate that the tenants would not have created the jobs in that area if it were not for the new development. If the project package cannot demonstrate with sufficient verifiable evidence that there is an unmet demand for the tenant’s services, USCIS will not give EB-5 investors credit for those jobs. Though it is possible to gain credit for jobs created by tenants through diligent representation, USCIS imposes such a high standard of proof that one should be extremely wary of investing in a project that heavily relies on tenant jobs.

Job-Creating Categories of Construction Costs

Economists use construction costs as the basis for job creation estimates of real estate developments. USCIS does not deem all construction costs to be job creating. Therefore, it is necessary to look carefully at the costs included in the job creation study.

A typical job creation report will distinguish between hard construction costs, soft costs, and FF&E (furniture, fixtures, and equipment). Hard construction costs are those incurred in actually building the project like materials and labor. FF&E includes the cost of furniture, fixtures, and equipment within the development. Soft costs include architectural fees, permit filing fees, financing costs, engineering fees, and legal fees. Generally speaking, almost all hard costs and FF&E can be included in calculating job creation. Some soft costs such as architectural and engineering can be included. However, it is extremely important to note that USCIS does not typically consider taxes, construction contingencies, permit filing fees, insurance, and financing costs to be job creating expenses. The contingencies are usually found in the hard costs section while permit filing fees, insurance, and financing costs are generally found in the soft costs section. If such non-qualified costs are included in the job creation estimate the number of jobs actually created by the project may be dramatically reduced. Due diligence requires careful attention to the construction budget in the economic impact study to ensure that non-qualified costs such as permit filing fees, insurance, financing costs, and contingencies were not included in the job creation calculation. Most experienced economists specifically exclude such items to avoid confusion.

Job Creation Timeline vs. I-526 Filing Date

USCIS has established an internal policy that each investor’s 10 jobs must be created within 2.5 years of filing the I-526 application. This is slightly at odds with EB-5 regulations and statutes, because according to EB-5 regulations, each investor’s investment must create the requisite jobs before the I-829 application becomes due. Given current processing times and retrogression for Chinese investors, it is extremely unlikely that any investor’s I-829 application will become due within 2.5 years of filing their I-526. Nevertheless, USCIS has been firm in its assertion that the requisite jobs be created within 2.5 years of filing an investor’s individual I-526.

Timely job creation is relatively straight forward for smaller developments where construction is less than two-years. With respect to the construction jobs, it is merely necessary to ensure that construction will be complete within 2.5 years after submitting the I-526 applications. For operations jobs, it is necessary to carefully evaluate the date used to establish revenue for calculating the operations jobs. That date, too, must be within 2.5 years of filing the I-526.

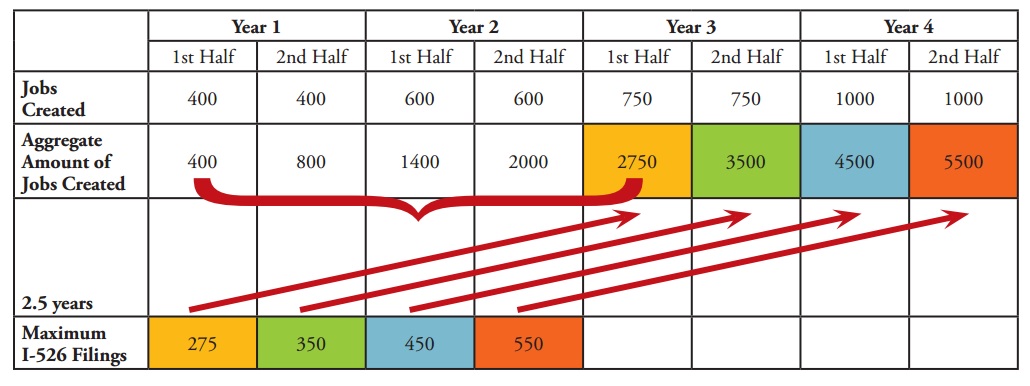

For larger projects where construction lasts more than two years, it is necessary to analyze the timing of job creation to ensure each applicant will be credited with creating the necessary number of jobs. The economic report should break down the number of jobs created every six months or year over the entire construction period. Based on the economic report’s job creation timeline, the business plan should provide an I-526 filing timeline showing the maximum number of investors that can file their I-526 applications every six months or one year.

This is typically done using a table like the sample below:

The table above shows a project seeking 550 EB-5 investors. Construction lasts four years and creates 5,500 jobs. It is not possible to file 550 applicants in year one, because not all 5,500 jobs will be created within 2.5 years of the I-526 filing date. You can see that in the first half of Year 1 a maximum of 275 investors can file their I-526, because only 2,750 jobs will be created within 2.5 years. Similarly, a maximum of 350 investors can be filed in the second half of Year 1, because the project should create 3,500 jobs within 2.5 years.

Due diligence requires an in-depth analysis of the job creating timeline and inquiry into the number of investors that have already filed their I-526 applications. It is necessary to verify that the project has not filed more I-526 applications than can be supported by the number of jobs created within 2.5 years after filing a particular investor’s I-526. If the project has already filed enough investors to account for the jobs created for the next 2.5 years it is best for the investor to postpone filing until they can be assured the requisite number of unallocated jobs is available.

Conclusion

Due diligence of an EB-5 project requires the ability to understand and ask critical questions about the project’s job creation. This article should be used as a guideline to critically analyze EB-5 projects from a job creation perspective.

DISCLAIMER: The views expressed in this article are solely the views of the author and do not necessarily represent the views of the publisher, its employees. or its affiliates. The information found on this website is intended to be general information; it is not legal or financial advice. Specific legal or financial advice can only be given by a licensed professional with full knowledge of all the facts and circumstances of your particular situation. You should seek consultation with legal, immigration, and financial experts prior to participating in the EB-5 program Posting a question on this website does not create an attorney-client relationship. All questions you post will be available to the public; do not include confidential information in your question.