by Nima Korpivaara

There is an enduring myth in EB-5 that direct investment projects are reserved exclusively for single investor owner/operators looking to open a business in the United States and earn a green card, while larger multi-investor EB-5 projects incorporating the “loan model” are the domain of regional centers. Like most myths, there is some truth to these assertions; regional centers do almost exclusively sponsor projects incorporating the loan model, and partly because of this additional investor security, regional centers have received the largest portion of EB-5 investment dollars. However, as there is nothing in the regulations preventing direct investment projects from subscribing multiple investors, direct investment projects are now combining their I-526 processing time advantage with the loan model to bring an end to the investor monopoly held by regional centers

Direct investment and the loan model

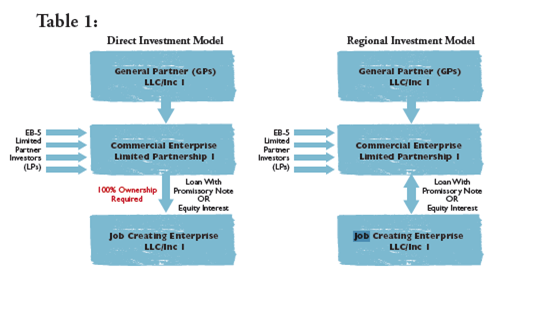

It is commonplace to hear that direct investment projects require an equity investment, while regional center sponsored projects may operate under the loan model. Investors typically shy away from equity investments, as those projects may not provide security against project failure, while developers shy away because they are looking for capital, not equity partners. Below are the typical business structures for both direct investment and regional center sponsored projects:

If these two structures look identical, it is because they are. In both charts, a new commercial enterprise (NCE) is formed for the purpose of accepting equity investments from potential EB-5 investors. Once the NCE is fully subscribed, it will make a loan to the job creating enterprise (JCE) or the project entity. In turn, the JCE will provide a promissory note back to the NCE, securing the funds. The only difference between the direct and regional center “loan” model is that, for there to be a sufficient nexus between job creation and the EB-5 investor funds, the NCE must wholly own the JCE in the direct model. That is it; there is no catch, or any other hoops. Same model, same results. Well, there may be one catch: direct investment projects have a possible investment structure that regional centers are less likely to offer.

The Regulations

Direct investments

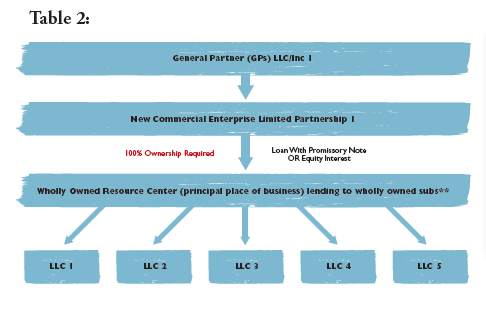

Though regional center projects are more popular in the EB-5 space, and the belief stands that multi-investor structures are in their purview, there is no legal reason that direct structures cannot enjoy the same opportunities. The regulations governing pooled investments in non-regional center cases (direct investments) allow for direct investment projects to subscribe multiple investors. Specifically, direct investment funds “may be deployed into a portfolio of wholly-owned businesses, so long as all capital is deployed through a single commercial enterprise and all jobs are created directly within that commercial enterprise or through the portfolio of businesses that received the EB-5 capital through that commercial enterprise”(see table 2). All investments must, of course, meet the requirements of the EB-5 program, but in plain English, the regulations state that (1) direct investment projects can subscribe multiple EB-5 investors; (2) direct projects can loan the EB-5 funds to several wholly owned project subsidiaries; and (3) the required jobs can be created by the project subsidiaries.

Further extrapolating the regulations, a project developer can accept and place EB-5 investment from multiple investors into multiple job-creating wholly owned subsidiaries, as long as the job creation is pro rata to each investor, i.e. one investor to 10 jobs; two investors to 20 jobs; three investors to 30 jobs; etc.

Looking at the regulations, the direct investment model is much more flexible than it is typically thought to be, allowing for multiple EB-5 investments into a single project and for the spreading of capital over multiple businesses. The model does not have to be as simple as one investor to one finite project.

Regional centers

The regulations concerning the regional center model continue, and address the key difference between the direct and regional center models—job creation. The regional center definition is inclusive of the above, but goes further, eliminating the wholly owned subsidiary requirement, and allowing for indirect job creation as demonstrated by reasonable methodologies.

Tracing the Myth

So what is the main difference between direct investment and regional center sponsored projects, and what has led to the myth? It is as simple as job creation. The recent economic downturn has created a difficult traditional lending market for large-scale construction projects. Hotel and mixed-use developers have seen their ability to raise low cost traditional financing disappear. This inability to develop has led to the rise of the EB-5 program. Where the banks have failed, foreign investors have prevailed.

Developers are able to raise large pools of low cost, low interest capital through the EB-5 program. The only issue: buying and developing land does not necessarily create jobs. Because regional center projects can count indirect jobs, they are typically able to accept more investors and comfortably attribute 10 jobs to each. It is for this reason that the regional center model has become so popular, and perhaps the reason why many see it as the only way to raise EB-5 capital through multiple investors.

Do the math; say a developer wants to build a mixed-use residential and retail building. Construction will last one year, and the cost will be $25 million. Dividing the total cost by the minimum required $500,000 investment means that 50 investors are required to fully fund the project. Each of those investors must then claim 10 jobs, meaning that the project must create at least 500 full-time payroll jobs. That is likely a non-starter, as a traditional construction project is unlikely to create that many long-term, full-time jobs. To remedy this situation, developers turn to regional centers and economic methodologies. Accounting for regional impact, industry cluster multipliers, and indirect and induced jobs, the project will likely get much closer to the 500 jobs requirement.

Consider a different example; not all projects are residential or mixed-use. What about a hospital? Same numbers—one year construction time frame and a cost of $25 million—only this time construction would yield 200 hospital beds. How many long-term, full-time physicians, nurses, assistants, and various levels of support staff are required to run a hospital with 200 beds? How many executives, accountants, and professional staff are required? Not something we often think about in the EB-5 field, but likely a lot closer to the 500 jobs than one would think.

Advanced direct investment structures – the new private equity fund model

What is a private equity fund? In its most basic incarnation, a private equity fund is an entity that aggregates investor funds for future investment into multiple projects at a desirable rate of return. This model is not often used in the EB-5 program because there may be uncertainty about how the funds will be aggregated and distributed, and whether the funds will directly create jobs. But what if the private equity fund knew exactly how the funds would be distributed? What if the model of the private equity fund was specifically designed to raise EB-5 investor funds to deploy into a wide array of job creating projects? As we saw above, the regulations allow this model as long as the “capital is deployed through a single commercial enterprise and all jobs are created directly within that commercial enterprise or through the portfolio of businesses that received the EB-5 capital through that commercial enterprise.” Yet the hurdle of job creation remains; how could the private equity fund ensure that there would be pro rata job creation for each and every EB-5 invested project?

Compare this chart to Table 1. It is essentially the same structure, but it follows the regulations word for word. Capital is deployed through a single commercial enterprise, and all jobs are created directly within that commercial enterprise or through the portfolio of wholly owned businesses that received the EB-5 capital from the wholly owned parent, the new commercial enterprise. Again, the NCE is formed for the purpose of accepting equity investments from potential EB-5 investors, only this time rather than lending to the JCE, the NCE will lend to a wholly owned subsidiary. From there the wholly owned subsidiary will perform the function of a private equity fund, by lending to multiple JCEs. The role of the wholly owned subsidiary is not absolutely crucial, as it could instead be the role of the NCE to ensure proper job creation pro rata to each investor. However, the wholly owned subsidiary, by performing accounting, marketing, training, pay roll, and additional functions, may qualify as the “place of principally doing business” for each wholly owned JCE—meaning that job creation for each and every single JCE will be counted at the wholly owned subsidiary level. This is potentially very important, as the prospect of one JCE falling short of the pro rata requirement by creating nine jobs rather than 10, resulting in the denial of the investor’s petition, may be avoided. The investor will not rely on one specific JCE, rather all created jobs across the JCEs will be divided amongst the investors.

Conclusion

The direct investment model may not suit the needs of every interested party, but for some it may be the more efficient and cost-effective approach. The direct investment model often times requires less documentation in that economist reports are not required, and direct projects that create sufficient jobs need not form relationships with existing regional centers for sponsorship. Additionally, direct investment I-526 petitions are currently adjudicated far more rapidly, regardless of how many times USCIS denies this.

This analysis is in no way meant to drive developers or investors away from the regional center model, but rather, it is only intended to shed light on some common misconceptions. The presented direct models can be treated the same as the regional center model for all intents and purposes.

DISCLAIMER: The views expressed in this article are solely the views of the author and do not necessarily represent the views of the publisher, its employees. or its affiliates. The information found on this website is intended to be general information; it is not legal or financial advice. Specific legal or financial advice can only be given by a licensed professional with full knowledge of all the facts and circumstances of your particular situation. You should seek consultation with legal, immigration, and financial experts prior to participating in the EB-5 program Posting a question on this website does not create an attorney-client relationship. All questions you post will be available to the public; do not include confidential information in your question.