(Reviewed by Eb5investors.com Staff June 2025)

What is EB-5 Capital?

EB-5 capital is a unique alternative to traditional sources of funds because it blends foreign direct investment with immigration incentives, offering significant advantages for both developers and investors. For developers, an EB5 loan or EB-5 funds offer an attractive non-dilutive alternative to equity. This means they can finance projects without giving up ownership or control. Unlike traditional debt or equity financing, an EB5 loan typically comes at below-market rates and with longer-term horizons.

EB-5 Visa Requirements 2025

Currently, under this program, the EB-5 investment amount that the foreign national must invest in a new commercial enterprise in the United States is $800,000 or $1.05 million. The amount varies depending on where the project is located, for example if it is in a TEA or urban area. Their EB-5 investment must also create 10 U.S. jobs.

The growth of the EB-5 Program

The EB-5 program was established in 1990 to encourage foreigners to invest in the United States and create American jobs in exchange for a U.S. green card. As credit markets tightened in the wake of the financial crisis, more and more American businesses and developers turned toward EB-5 funds to raise the required capital for their EB-5 projects. Congress established the Immigrant Investor Program, or EB-5 program, in 1990 in order to stimulate the U.S. economy. How can the EB-5 program benefit you as a developer?

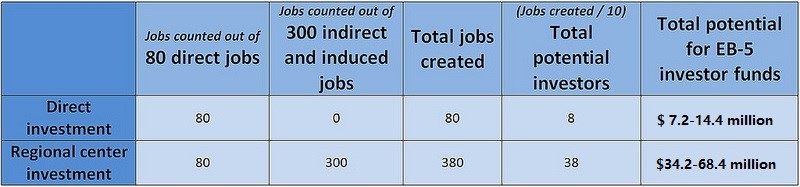

In 1992, Congress expanded the program by creating the Immigrant Investor Pilot Program, which established EB-5 Regional Centers. Regional centers allow EB-5 investment funds to be pooled together in USCIS-designated enterprises, and allow for investments in projects that require a larger inflow of EB-5 capital. Investing through an EB-5 regional center also holds a benefit for the investor, as he or she is allowed to count indirect and induced jobs toward the job creation requirement. Because regional centers and investors do not have to worry about creating 10 direct jobs per investor, multiple EB-5 investors can invest in the same project and they can all meet the job creation requirements to obtain an EB-5 visa and green card.

The EB-5 job creation and capital raise

For example, consider a $90 million hotel project that is expected to create 80 direct jobs, and 300 indirect or induced jobs. Such a project could accept eight EB-5 investors (at either the $800,000 or $1.05 million investment level) if only direct jobs were counted, as is required in the case of a direct investment. This would raise a total of $7.2-14.4 million of immigrant investor funds for the project. Through a regional center, however, the project could count the additional 300 indirect and induced jobs, bringing the total job count up to 380, and the maximum number of EB-5 investors up to 38—allowing the project to raise $34.2-68.4 million in EB-5 investor capital.

The EB-5 Capital Raise

Though the EB-5 regional center program is often seen as a win-win, it is not without difficulties. It is important to consider all the requirements and costs of the process and all the available options.

EB-5 Regional Center Designation

One means of raising EB-5 capital is for the developer to seek regional center designation from USCIS. This process requires you to submit an I-924 application for EB-5 regional center designation and supplemental information that outlines the geographic and industrial scope of the regional center, as well as the economic impact and job creation prospects of the regional center’s projects. The approval process is lengthy and may require you to respond to multiple requests for evidence (RFE) from USCIS, sometimes turning the approval into a years-long process.

Affiliate With an Existing EB-5 Regional Center

If you are a developer that is looking to raise funds in the immediate future, it may be a better choice to work with an existing USCIS-designated regional center. Many existent EB-5 regional centers will accept the projects of outside developers.

EB-5 Direct Investment

If you are considering the direct investment route, you would receive an investment directly from an individual investor and would not associate with a regional center. The benefit of this is that you would not have to file an I-924 application with USCIS as a developer, but you must take into account the stricter job requirements for this option.

The benefits of EB-5 Investments

Overall, the EB-5 Immigrant Investor Program is a popular and viable option for developers in a wide array of industries, especially after the EB-5 Reform and Integrity Act of 2022 updated the program. If managed properly by an individual developer, and used for the right projects, the EB-5 visa program is a legitimate and unique option for financing commercial enterprises in the United States.